While everyone was busy withdrawing their funds from FTX, and others pointing fingers in different directions, a whole lot of others do not know what the real story is . Hence the reason for this brief summary. WHAT IS THE REAL STORY?

In this post, we shall take in bits thus:

- Who is Sam Bankman Fried?

- How it all began (FTT Token Creation)

- What really happened

- How Binance dragged them out

- The final result (downtrend)

- What now? The way forward So now, let's get it started.

WHO IS SAM BANKMAN-FRIED?

Sam Bankman Fried, also popularly known as SBF (which I'll be using more in this content), is the founder and former CEO of FTX.

FTX was one of the world's largest cryptocurrency exchanges valued at $32 billion and a major competitor with Binance. As an exchange, they allowed people to buy, sell, and interact with various financial processes.

SBF also co-founded a quantitative trading firm called Alameda Research. This firm had specialty in market making, yield farming and trading volatility. Even though SBF had said that these two firms were different and independent of each other, they exhibited some close ties that were very questionable (The architect of the problem).

Before now, SBF has been regarded as the crypto messiah, who was always bailing out other firms in distress. But then, according to an anonymous report made to wall street journal, Alameda Research suffered series of losses in May and June of 2022, which resulted in FTX lending the trading firm more than half of its customer funds. A decision contrary to the FTX terms and service.

So, what happened? Was it wrong to have helped a sister firm? Before we dive into that, let's take a look at the FTX token called FTT and the fuse behind it.

FTT TOKEN CREATION AND OBVIOUS FUSE

FTX decided they wanted to create a digital token for their firm and announced that this token will be the backbone of the FTX platform. After all, this is crypto and anyone can create a token from thin air. 🤷So, they went ahead, to create the token.

As a well thought out marketing Strategy, this token became the Hallmark of discount payment on the FTX exchange where Customers who bought FTT were able to execute trades on the company's exchange at a discount. They could also use the tokens as collateral. The company regarded the token holders as VIPs. (I mean, who wouldn't want to become a VIP of a well known exchange 🤷 but this wasn't the problem).

SO, WHAT THEN WAS THE PROBLEM?

I made a post sometime ago about the understanding factors that affect a project's tokenomics before investing into any project and in the FTT case, the Distribution was not clear enough for people to make a wise investment decision.

Earlier this month Coindesk (A cryptocurrency news site) was opportune to review a private financial document of Alameda spreadsheet and an article preceded, revealing that Alameda balance sheet was full of FTT TOKENs which invariably means that they were the largest owners of the exchange tokens (Red flag).

SBF had always said that these companies were independent of each other, so on the revealing of the balance sheet, lots of questions arose on 'why are the majority of their assets in FTX?' Why are they not in fiat or any other currency?'

Is there something we don't know of? Could the FTX token be a fugazy? All these questions and more came up but it was still on a low key until the rival company (BINANCE) did the unthinkable.

WHAT DID BINANCE DO?

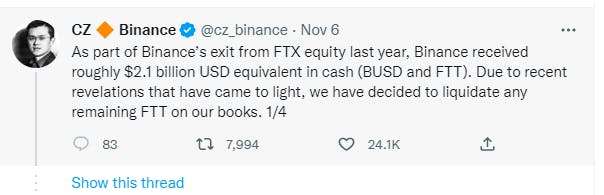

Normally, when you learn of these kind of revealing, the easiest thing you can do is to sell off your portion of the token without announce unfortunately, the founder of Binance Changpeng Zhao popularly known as CZ, made an announcement on twitter that he would be selling off the remaining portion of FTT on his books.

(😲with the kind of influence and personality Cz had, there was no way that could have gone well 🤔). This announcement alone caused the massive withdrawal of funds on the FTX exchange while others on trade had to liquidate themselves to secure their funds. And just in 72 hours, people withdrew over $6 billion and FTX lost grip on its value.

Binance then offered them a lifeline in a non binding agreement and agreed to purchase the company

Unfortunately, the bailout didn't work as Binance Tweeted, as a result of due diligence and also pointed out a mishandling of customers funds and alleged US agency investigation.

THE FINAL RESULT

These resent events has caused the FTX collapse and has further tarnished the industry that is still recovering from the collapse of crypto prices in May amidst rising interest rates.

The spectacular fall of FTX could bring more regulation to the crypto industry.

The US bans a risky form of crypto trading in which investors borrow money to make huge bets on the future price of cryptocurrencies. FTX US is the American arm of FTX and is for basic trading, so as to comply with US regulations.

FTX halted withdrawals until further notice then they filed for bankruptcy and SBF resigned while a new CEO takes over.

When SBF resigned as CEO, he said " I'm really sorry again that we ended up here. Hopefully, this can bring some amount of transparency, trust and governance".

Unfortunately, those are just empty words for customers.

THE WAY FORWARD

The new CEO and Chief restructuring officer at FTX is John Ray, who handled the largest bankruptcy in US history at Enron. At that time, Enron had liabilities of $23 billion and let's guess that FTX liabilities maybe double that amount to $50 billion.

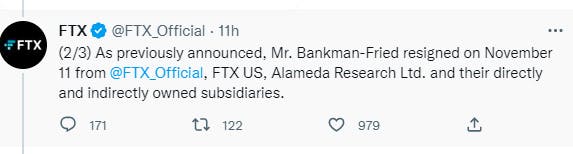

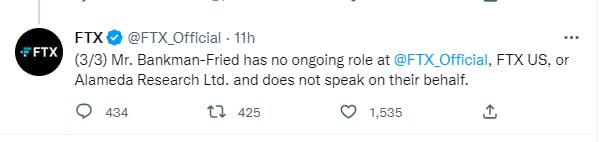

SBF on his part has been on a tweet spree on twitter and the new FTX CEO has finally come to address these tweets that SBF no longer speaks for the company as well as reminding SBF that he is the new CEO now.

Crypto is still a new and untested market and despite the current situation, many believe it is the future of finance.

What's your take on this? Is there hope for crypto? Will FTX ever recover? Did I miss something in the story? Kindly share your opinion in the comment section